By THE INDEPENDENT UG

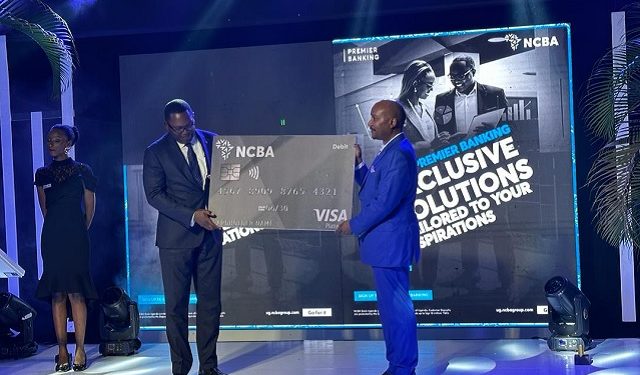

Kampala, Uganda | JULIUS BUSINGE | On Feb.22, NCBA Bank unveiled its revamped Premier Banking offering, targeting premier banking customers, prospects, and high-value stakeholders.

The key features of the enhanced offering include extended banking hours at select branches, allowing customers to enjoy greater convenience.

Additionally, customers now have access to online and mobile banking platforms for seamless transactions, enhancing convenience further.

One of the highlights of the new proposition is the access to lifestyle privileges and discounts linked to debit and credit cards. Premier Banking customers, along with their spouses and children, will also enjoy recognition and benefits, underscoring the personalized approach to banking.

In terms of customer service, Premier Banking customers will receive priority at the Contact Center, with a dedicated Premier Banking line available 24 hours a day. They will also benefit from priority processing of transactions and preferential terms on lending facilities.

Moreover, Premier Banking customers will also receive invitations to exclusive events organized by NCBA Bank, adding an extra layer of exclusivity to the offering.

The bank’s Chief Executive Officer, Mark Muyobo said, “Premier customers will continue to enjoy preferential rates on deposits and forex, access to international Visa Banking Platinum Cards that come with Lifestyle benefits such as seamless online bookings for hotels, flights with VIP Lounge Access across airports all around the world and exclusive lounges at select branches.”

NCBA Bank is also expanding its Premier Banking services to include Diaspora Banking, catering to customers who transact and save from anywhere in the world. Diaspora Banking offers current and savings accounts available in foreign currency and Uganda Shilling, with savings accounts bearing interest depending on the account balance.

Furthermore, NCBA Premier Banking offers a wide range of property finance solutions, including mortgage loans, plot loans, construction loans, equity releases, and buy-and-build financing.

Customers can also access secured loan facilities, investment solutions, and various banking solutions tailored to meet their financial needs.

Discussion about this post