By SUDAN TRIBUNE

March 31, 2024 (JUBA)- South Sudan has issued a statement unveiling immediate measures to stabilize the exchange market, highlighting the extent to which consumer prices have risen, amid falling levels of basic commodities, usually imported from neighboring countries.

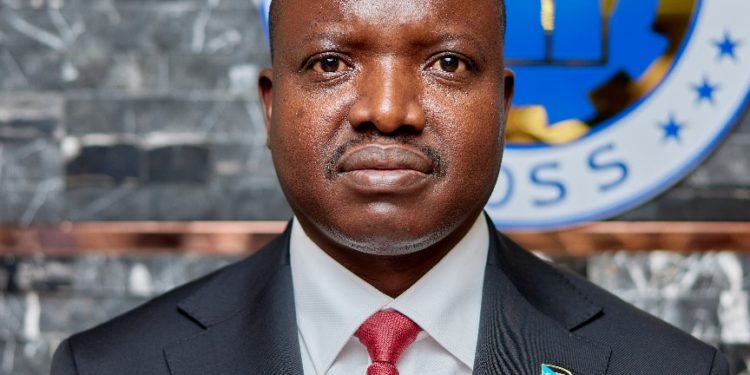

James Alic Garang, governor of the Central Bank of South Sudan said in a statement on March 29, 2024, the bank, together with the Ministry of Finance and other relevant institutions in the country is closely monitoring developments in the foreign exchange market.

The bank has taken proactive measures and mobilized sufficient foreign exchange resources to intervene in the market with immediate effect, said Garang. He revealed that One of the immediate actions taken by the authorities is clearing outstanding auction claims and coordinating with the ministry of finance to pay one-month salaries for civil servants, army, police, and members of the organized forces as well as public sector employees.

Other interventions extend to monetary policy rates that strengthen the purchasing power of the local currency, through weekly action of foreign exchange at a revised preferred rate of the bank.

The bank also seeks to promote transparency to enhance liquidity, maintain a fair and orderly market environment, and enhance regulatory oversight.

According to the statement, the bank will work closely with the Ministry of Finance and Planning and other economic agents of the government to bolster efforts to foster a resilient and competitive foreign exchange market for sustainable economic growth and development. It urges members of the public to adopt electronic payment systems to lessen large amounts of cash outside the banking system. Economic and fiscal experts have lauded the central bank’s policy to communicate with the public.

This represents a new departure from the past approach in which economic and monetary activities and deals were conducted in the dark, blocking doors for transparency and accountability.

The new approaches have however drawn in mixed reactions, with some arguing the approach indicates the bank “does not possess hard currency and is not able to cover demand in the markets for foreign currency, describing the move to approximate the black-market rate “a tacit recognition by the central bank that it is devoid of hard currency.” Others have argued the central bank is also trying to “compete with the black market for foreign currency, by attracting remittances and hard currency transfers to the central bank’s channels”.

This policy, argued monetary experts, “the central bank has changed its monetary policy from stabilization to partial floating.” Some have called the central bank’s approach to the black-market exchange rates a “good policy,” encouraging efforts to “drive many transfers and economic activities towards the official market, instead of the black market.”

It also led to the unification of multiple central bank exchange rates under the “official market bulletin, after there had been a bank bulletin and an exchange bulletin, which simplified monetary procedures.

“The central bank is overloaded,” argued Santino Deng Mawien, a South Sudanese based in Kampala, Uganda, studying master of economics at Nkumba University.

Mawien said “the main problem is economic management based on oligopoly, extortion, looting, and theft,” “reduces the chances of the economy improving as it should,” given that “the majority of those able to produce and integrate into the market and get the wheel of the economy turning again are apprehensive about entering the market for fear of their wealth being stolen, extortion,” negatively impacting “economic recovery.”

Accordingly, without real will and serious steps from those in power, the central bank’s efforts to stop the collapse of the South Sudan pound cannot succeed, and it will continue to pursue black market exchange rates.

(ST)

Discussion about this post